Finance Minister Bill Morneau confirmed that the federal government will extend the Canada Emergency Wage Subsidy (CEWS) to December 19, 2020. He also announced details on how the program will be revised.

How do the new rules work?

The new rules have two different CEWS rate structures – one calculated based on remuneration paid to active employees and the second for employees that are furloughed (i.e., on leave).

The subsidy rate for active employees is based on a two-part calculation that determines:

- a base subsidy rate designed to apply to most employers who have seen a business decline, plus

- a top-up subsidy rate for employers affected more severely

The total subsidy rate is then applied to eligible weekly remuneration. The eligible remuneration amount for each arm’s length employee is the amount paid in respect of the week, up to a weekly maximum of $1,129 per employee. For arm’s length employees, baseline remuneration is no longer part of the calculation, but it remains relevant for non-arm’s length employees.

The overall CEWS subsidy for each week for active employees therefore equals the base CEWS rate plus the top-up CEWS rate times the total eligible remuneration.

How is the base subsidy rate calculated?

For period 5 and later periods, employers with a revenue decline — even of less than 30 per cent — will be eligible for a base CEWS rate for active employees. The rate depends on the actual decline in revenue – the higher the decline, the higher the rate. Where the decline is 50 per cent or more, the base rate is capped at 60 per cent for periods 5 and 6. This cap drops further for periods 7, 8 and 9.

Like the original rules, employers can compare their current revenue to:

- their revenue in same month in 2019 (“general approach”), or

- their average monthly revenue for January and February 2020 (“alternative approach”)

For this test, employers can use revenue for either the current or prior month, so they can automatically qualify for the following period using the same revenue reduction when this is to their benefit.

The comparison test chosen for period 5 claims must then be used for the balance of the program for calculating both the base and top-up CEWS rates (as we discuss later). The choice made for periods 1 to 4 under the original rules does not affect the decision for period 5.

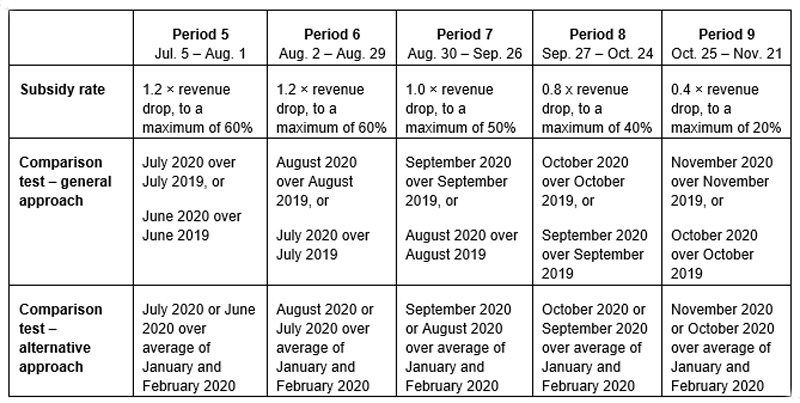

The chart below sets out the rate formula and comparison periods for periods 5 to 9.

For example, if the revenue drop in period 5 using either the general approach or the alternative approach is 40 per cent, the base subsidy rate is 48 per cent (1.2 × 40%).

How is the top-up subsidy rate calculated?

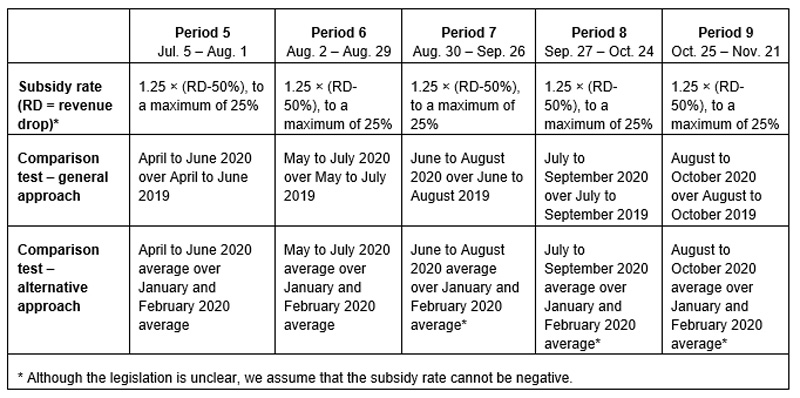

The top-up portion of the subsidy aims to help employers whose revenue has dropped by 50 per cent or more. Similar to the base subsidy, the top-up rate varies based on the size of the revenue drop and is subject to a cap of 25 per cent. This cap applies if the three-month average revenue drop is 70 per cent or more. However, unlike the base subsidy, the rate and cap amounts do not decline over time.

The revenue drop is determined under the general approach by comparing revenues in the preceding three months to the same months in the prior year. Under the alternative approach, the drop is determined by comparing average monthly revenue in the preceding three months to the average monthly revenue in January and February 2020.

The rate formula and the specific comparison periods are set out in the chart below:

For example, where the revenue decline is 60 per cent, the subsidy rate is 12.5 per cent [1.25 × (60% – 50%)]

How will the subsidy apply for furloughed employees?

The new rules set a separate calculation for employees who have been “furloughed.” For period 5 and later periods, the CEWS for furloughed employees will be available to eligible employers who qualify for the base or top-up rate for active employees in the relevant period.

The subsidy amount for furloughed employees depends on the claim period:

- For periods 5 and 6, the subsidy is the same as for periods 1 to 4, that is, the greater of:

o for arm’s-length employees, 75 per cent of the amount of remuneration paid, to a maximum benefit of $847 per week; and

o 75 per cent of the employee’s pre-crisis weekly remuneration, to a maximum benefit of $847 per week or the amount of remuneration paid, whichever is less.

- Beginning in period 7, CEWS support for furloughed employees will be adjusted to align with the benefits provided through the Canada Emergency Response Benefit (CERB) and/or Employment Insurance (EI).

For period 7 and beyond, the exact amount of the subsidy is unclear as the legislation refers to a regulated amount. We’ll keep you posted as details become available.

Also, the employer portion of contributions for furloughed employees to the Canada Pension Plan, EI, Quebec Pension Plan and Quebec Parental Insurance Plan will continue to be refunded to the employer.

OTHER CEWS CHANGES

Along with the new formulas and calculations, employers and their advisers need to consider some other important changes to the program, including these amendments:

Eligible employee definition modified

Starting in period 5, an employee no longer has to be paid for 14 consecutive days to meet the definition of an eligible employee.

Deadline to submit claims extended

Qualifying entities can still apply for the CEWS retroactively, as long as their applications are received before February 2021 (instead of the previous September 30, 2020 deadline)

Entities using the cash method of accounting can elect to use the accrual method for CEWS

Under the new rules, entities that use the cash method of accounting can elect to use the accrual method for the CEWS. Once this election is made, it must be applied to all qualifying periods. This change applies to all periods.

Formal appeals process now in place

The rules will provide for an appeal process based on the existing procedure for notices of determination that allows for an appeal to the Tax Court of Canada.

Baseline remuneration periods expanded

In addition to the original baseline remuneration period of January 1 to March 15, 2020, Bill C-17 proposed to add an alternative baseline period that begins on March 1, 2019 and ends on May 31, 2019.

Important Observations

- The accuracy of monthly revenue calculations will be more important under the new rules for some employers as the specific decline in revenue will directly impact the CEWS subsidy rate. Under the original rules, it may have been clear that the revenue reduction was far in excess of 30 per cent. Similar, the importance of good documentation has increased.

- Given the safe harbour rule for periods 5 and 6, employers should apply both the original rules and the new rules to see which approach produces the best results.

- In period 5, employers must decide whether the general approach or the alternative approach gives better results for revenue comparisons.

Please contact your CSM for assistance with your CEWS claim.